It’s not rocket science

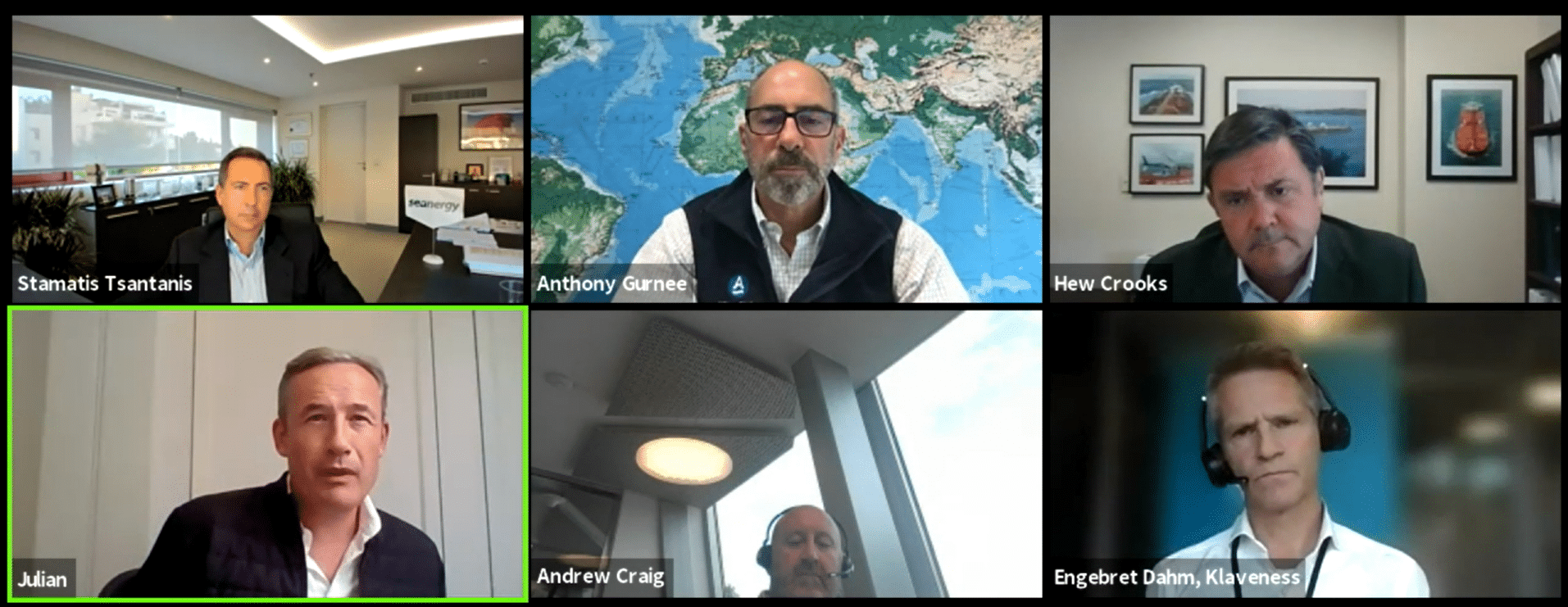

Marine Money’s first Climate Week event provided a perfect opportunity for some of the big guns of shipowning and operations to share their progress on lowering pollution and carbon emissions.

And it turns out that, while the industry makes short term choices between LNG and Methanol as transition fuels, operators are looking at enhancing performance with the better use of data.

There is plenty that can be done provided a consistent flow of information can be captured but there are issues that the panel of largely tanker operators acknowledged; things will need to change further and faster in future.

Hew Crooks, Chief Financial Officer & Partner, Ridgebury Tankers said that his customers are under pressure to take ownership of decarbonisation, which meant his fleet had to be more efficient.

The key is knowing if the ships can achieve efficiency ratings that are attractive to customers. “The pressure will be from customers who perhaps won’t charterer lower than a C or D CII rating. When customers pay spot freight, fuel efficiency is the owners’ problem; the savings go to your pocket but vessels have to be competitive.”

Improving performance was he said a series of baby steps “but we have the language now, the Poseidon Principles caused us to start monitoring and measuring; two years ago we couldn’t have told you much [about vessel performance].

The root problem seems to be that owners lack an effective means of measuring real time emissions so they can share data with their charterers.

Anthony Gurnee, CEO, Ardmore Shipping said his company needs “a system that measures carbon perfectly and accurately; we can’t measure this with a dipstick”.

Reducing emissions takes a combination of operational improvements to propellor performance, hull coatings and constant engine load. “Using operational trim and speed improvements together with weather routeing we can get [savings] well above 10%, but the challenge is accurate measurement and data management.”

Stamatis Tsantanis said Seanergy Maritime Holdings Corp has teamed up with an AI firm, using telemetry to monitor systems in the engine room with dozens of devices providing metrics. “Its not one [fleet] solution, each is custom made,” he said. Using a wide combination of energy saving devices he thinks a standard Korean-built ship could save 14-15% of fuel consumption, a Japanese vessel 10-12%. “But this has to be done in co-operation with the class society and the charterer participates too,” he added.

The trickier question is whether the owner-charterer relationship can be reconfigured in a lasting way. Engebret Dahm, CEO of Klaveness Combination Carriers said it is still early days “but we are introducing sustainability features into contracts, reporting and tracking the performance of ships. We have targets to establish specific performance because the carbon price for freight will depend on the performance of the ship.”

Klaveness is part-financing some initiatives and Dahm believes sustainability is about more than reducing hull resistance. “Our advantage is contracts of affreightment; we are master of ships so speed performance data stays with us.”

Gurnee added that non-CPP cargoes now account for 25-40% of Ardmore’s tanker business and it is looking at carrying more transition fuels as cargoes and agreeing longer term time charters that “help cashflow and the environment”.

What is certain is that the industry will have to get its data together pretty soon. The EU emissions trading scheme is approaching at very high speed and EU carbon costs will have a ‘very material effect’ since they will be priced off EU allowances currently mid-$60s/tonne, he said. “At that point carbon compliance becomes an owner obligation and it becomes a price risk, not just a charter party clause, this is a compliance market.”

Asked what they thought the future would look like, Crooks remarked that the new structure of the industry is too difficult to predict. “I have more confidence in a five-year outlook, I stay away from 20-year predictions.”

And as he pointed out, in the end, owners will face more existential threats. “How can we be confident that someone does not just look at the ship, but how far it’s moved. Tonne mile growth is not climate-aligned.”